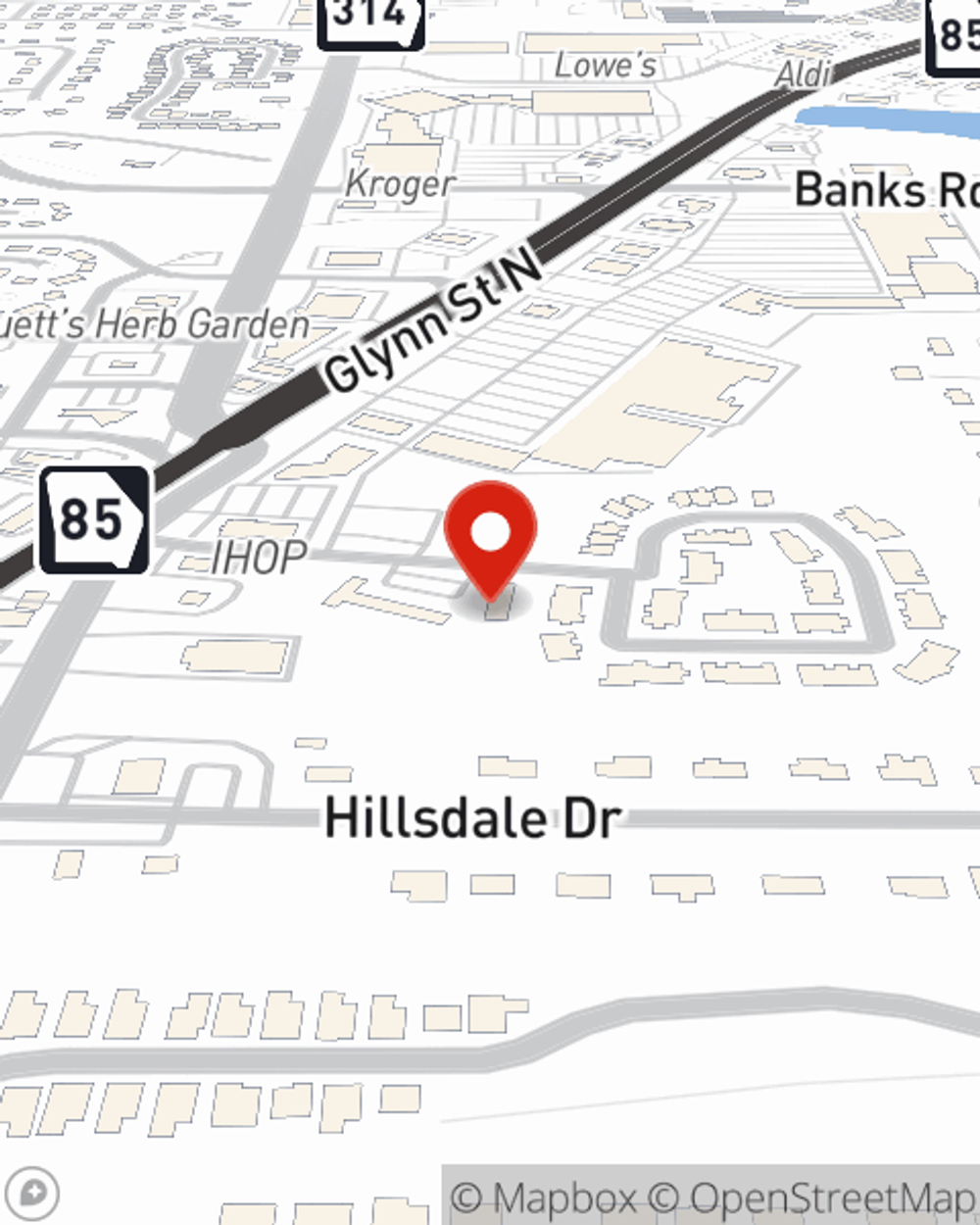

Business Insurance in and around FAYETTEVILLE

One of FAYETTEVILLE’s top choices for small business insurance.

No funny business here

- FAYETTE

- FULTON

- CLAYTON

- COWETA

- SPALDING

- COBB

- MERIWETHER

- ATLANTA

- FAYETTEVILLE

- PEACHTREE CITY

- NEWNAN

Cost Effective Insurance For Your Business.

Whether you own a a lawn care service, a clock shop, or a confectionary, State Farm has small business protection that can help. That way, amid all the various moving pieces and options, you can focus on navigating the ups and downs of being a business owner.

One of FAYETTEVILLE’s top choices for small business insurance.

No funny business here

Insurance Designed For Small Business

When one is as enthusiastic about their small business as you are, it makes sense to want to make sure everything is in order. That's why State Farm has coverage options for business owners policies, worker’s compensation, surety and fidelity bonds, and more.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Zan McBride is here to help you learn about your options. Visit today!

Simple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Zan McBride

State Farm® Insurance AgentSimple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.